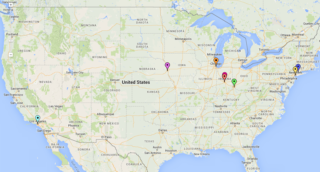

Coast to Coast

As you can see from the map above, we’ve literally flown coast-to-coast in support of our research efforts. Besides several Midwest cities, we hit New York twice and Los Angeles once. During our recent travels, we visited:

- Three companies

- Four hedge funds

- Two conferences

- Two private equity funds

- Two mutual funds

Of course the centerpiece of our travel was our annual pilgrimage to Omaha for the Berkshire Hathaway annual meeting. Today, Berkshire admirers can quickly locate a transcript of Warren Buffett and Charlie Munger’s full comments online. But the thrill of the trip is the opportunity to network with likeminded value investors. The wife of one of our friends likes to call the event “nerd-fest.” We prefer Buffett’s moniker: “Woodstock for Capitalists.” Buffett is executing as well as ever, having recently signed attractive deals to acquire Kraft Foods and Precision Castparts. In the 2015 annual letter, Buffett observed that Berkshire “now owns 9½ companies that would be listed on the Fortune 500 were they independent,” with the ½ attributable to their 50% interest in Heinz. The deals for Kraft and Precision increase this count by 1½. On marches Berkshire!

Instead of boring you with a ton of details from these trips, we thought we’d share a few brief stories from our travels:

- In Los Angeles, we had the chance to meet with a hedge fund manager closely affiliated with some of our investment heroes. The manager has assembled an outstanding long-term record investing mostly in emerging markets and his personal history is fascinating and inspiring. The visit solidified several themes we’ve been exploring for some time. First, investing is a competitive game, and it’s easier to win if you have the willingness and ability to explore more “inefficient” areas of the market. However, these areas are inefficient precisely because they require certain skills, abilities or a general temperament that are unusual. Second, the best investors we’ve met have a definite blend of confidence and humility. In short, they “know what they know” and don’t have problems admitting what they don’t know. In an industry not lacking for large egos, our experience has shown that the best of the best tend to be genuinely nice people. Finally, nearly all great investment records have been assembled on the back of Buffett’s observation: “The stock market is designed to transfer money from the active to the patient.” The great investors have the temperament to wait for the right opportunities, to patiently build their own mental capital and to drown out the significant noise generated daily in financial markets.

- In New York, we visited with a distressed private equity fund focused on messy situations. The companies they purchase are rife with problems. They are often losing money, have problems with union negotiations, operate in declining industries, etc. This outfit typically purchases these businesses from larger companies that simply want to get rid of the headache. While this sounds risky, the group has built their expertise on approaching such opportunities in low-risk ways. They insist on strong balance sheets at the time of purchase, they partner with best-in-class operators and they insist on incredibly low purchase prices, often below liquidation value. They have a motto: “Focus on the downside; the upside will take care of itself.” We like that.

- We worked on various “scuttlebutt” projects in the field, speaking with competitors, employees, and customers of stocks that we were exploring. Our chief task when researching a stock is determining whether the company can successfully fend off competitors for the foreseeable future. We try to only purchase companies that we are comfortable holding for the long-term. We want marriages, not one-night stands; we think it’s much easier to find happiness with the former. But we are consistently amazed at the intense competitiveness of the U.S. capitalist system. For nearly every company we research, there is some other company or entrepreneur out there devising a plan to steal customers, market share and value. For every Walmart, there is a Jeff Bezos hatching plans for the next Amazon. This is decidedly good for society as a whole – it’s what has created the American economic growth engine. But for individual companies, managers and employees, it can be daunting. Only those with inherent competitive advantages, a culture of integrity and hard work and forward-looking management can expect to persist for generations to come. (Jim Collins has profiled such attributes in his various books, all worth a read.) J.P.Morgan found that between 1980 and 2014, 40% of all stocks suffered a “catastrophic decline” – falling by 70% or more and never recovering (biotech and energy companies were especially susceptible). Two-thirds of all stocks underperform the broader benchmark over their lifetime, on average by 50%.1 This is “creative destruction” at work.2

Charlie Munger was recently asked about the low interest rate environment and where rates might go from here, to which he responded: I didn’t predict they would end up so low, so why do you think I can predict what happens next? It’s an interesting exercise – when purchasing a stock, would you have been able to forecast what happened to the business the last ten years if you had tried such a thing ten years ago? If the answer is clearly no, what makes you so certain you can have any success predicting the next ten years?

1“The Agony and the Ecstasy: The risks and rewards of a concentrated stock position,” J.P.Morgan Eye on the Market (Special Edition), 2014.

2Coined by economist Joseph Schumpeter in 1942.

Reproduction or distribution of this material is prohibited and all rights are reserved.

Past performance is no guarantee of future performance. All investments contain risk and may lose value. Any views expressed within this document are the views of AMI Investment Management and/or the authors. They are subject to change at any time without notice. Any graphs, charts or formulas included within this document that depict historical relationships may not be valid during future periods and should not be relied upon to make investment decisions. This material is distributed for informational purposes only and should not be considered as investment advice or as a recommendation of any particular investment security, strategy or investment product.