Market Volatility

“It’s not the years in your life that count. It’s the life in your years.” –Abraham Lincoln

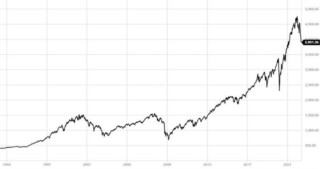

As we reflect on the last thirty years in this business, we have experienced many “corrections” (peak to trough decline of 10% plus) and bear markets (peak to trough decline of 20% plus). However, as the chart above displays, the overall trend for the S&P 500 Stock Index has been up.

The 1990's

The 1990’s brought us mullets, grunge rock, the end of the Cold War and two major market-moving events. In 1998, we had the Asian Financial Crisis and the Long Term Capital Management bailout. The crisis began in Thailand, when the government unpegged the Thai currency from the U.S. dollar, setting off a series of currency devaluations and a massive flight of capital. The crisis spread throughout Asia and eventually to Russia. The Russian devaluation led to the collapse of Long Term Capital Management, a hedge fund founded by Nobel prize winning economists who were taken down by their own hubris, i.e. “not knowing what they don’t know.” When all the dust settled, the stock market had declined 19% from July 17, 1998, to the end of August 1998.

The 2000's

In the 2000’s we saw the rapid deployment of innovative technologies tied to the Internet and smaller and smarter phones. We also had two of the biggest bear markets going back to the Great Depression. In the late 1990’s we had an explosion of IPO’s tied to the new, online economy. Just by putting “.com” at the end of their corporate name, companies with no earnings were being valued at ridiculous levels by the stock market. When the bubble finally burst on the dot.com mania, the stock market was down 49.1% from March 24, 2000, to October 9, 2002.

Near the end of the decade, we had the Global Financial Crisis in 2008-2009. It took extraordinary measures by the Federal Reserve Bank (the “ Fed”) and the Treasury Department to avert a collapse of our financial system. In October of 2008, several market pundits went public saying stock prices had bottomed and they were buyers. This market call was followed by an additional 29% decline before prices officially bottomed in March of 2009. When all was said and done, the market declined 56.8% from October 9, 2007, to March 9, 2009.

The 2010's

The 2010’s brought us the iPad, Instagram and Tik Tok. The major market moving events of the decade included the May 6, 2010 “Flash Crash” where stock prices plummeted 9% intra-day in a 36-minute period. In July of 2010, the stock market plummeted 19% due to the European sovereign debt crisis. Additional market turbulence was caused by China devaluing its currency in 2015 while the ripple effects of Brexit occurred in 2016. From September 20, 2018, to December 24, 2018, the stock market fell 19.8% over concerns with the U.S.-China trade war, the Fed starting to raise interest rates, and the price of oil plummeting.

The 2020's

The 2020’s so far have brought us a global pandemic and lots of uncertainty. In the Spring of 2020, when the global lockdowns went into effect and the economy ground to a halt, the stock market declined 34% from February 19, 2020, to March 23, 2020. As the Fed pumped liquidity into the market, the government mailed out stimulus checks, and Covid vaccines were rapidly developed, the stock market recovered and set record highs through the end of 2021. Which brings us to the present where we find ourselves in a bear market brought on by a combination of a rapid rise in inflation, the Russian invasion of Ukraine and the Federal Reserve Bank raising interest rates aggressively to try to tamp down inflation.

At the close last Friday, the stock market was down 19% from its January 2022 peak. At the beginning of the year, the markets were forecasting 2-3 quarter-point interest rate hikes over the next 12 months. Once it became clear that inflation was accelerating and the war in Ukraine would only add to the inflation pressures, the Fed found themselves behind the curve and had to quickly shift to a much more aggressive interest rate policy. Now, the markets are forecasting 7-8 quarter-point interest rate hikes this year. Capital markets don’t like uncertainty and this major change in the outlook for interest rates has caused a rapid revaluation of stock and bond prices. Tech stocks, that were the darlings of the pandemic driven work-from-home movement, have been hit particularly hard this year.

The table below from Bloomberg shows the average forward 12-month return following the declines of 10%+ over the last five decades.

Decade # of Intra-Year Declines of 10%+ Average Drawdown Average Length (Months) Average Forward 12-month Return

1970's 5 -19.30% 7 18.59%

1980's 3 -17.89% 5 30.83%

1990's 2 -14.07% 4 36.66%

2000's 5 -25.01% 7 3.94%

2010's 3 -13.56% 3 26.73%

Past performance is no guarantee of future returns, but the data in the table is compelling for long-term investors. The forward 12-month return, from the March 2020 pandemic low was 56.4%! Market corrections are no fun when you are in them, but investors who stay invested can see significant long-term returns.

Capital markets are recognizing a regime change with both interest rates and inflation moving off of record lows to higher levels and an increasingly uncertain geopolitical environment. Volatility is likely to remain elevated until we get more clarity on inflation and the neutral level of interest rates (the rate at which the Fed is neither stimulating nor cooling the economy). We know that market corrections can cause stress and anxiety. However, it is helpful to remember that intra-year declines are quite normal as we outlined earlier in our walk down memory lane. In all the intra-year declines we outlined, the equity markets were set up for attractive returns going forward.

No one can predict the timing of the ups and downs in the market. The best course of action over time has been to build a diversified portfolio that includes both high-quality bonds and stocks that can weather the inevitable storms. Please don’t hesitate to contact us if you want to discuss your portfolio and the current market environment.

Reproduction or distribution of this material is prohibited and all rights are reserved.

The S&P 500 Stock Index is used for all stock market performance calculations referenced in this paper. Past performance is no guarantee of future performance. All investments contain risk and may lose value. Any views expressed within this document are the views of AMI Investment Management and/or the authors. They are subject to change at any time without notice. Any graphs, charts or formulas included within this document that depict historical relationships may not be valid during future periods and should not be relied upon to make investment decisions. This material is distributed for informational purposes only and should not be considered as investment advice or as a recommendation of any particular investment security, strategy, or investment product.